By Robert Faturechi, ProPublica

After Sen. Richard Burr of North Carolina dumped more than $1.6 million in stocks in February 2020 a week before the coronavirus market crash, he called his brother-in-law, according to a new Securities and Exchange Commission filing.

They talked for 50 seconds.

Burr, according to the SEC, had material nonpublic information regarding the incoming economic impact of coronavirus.

The very next minute, Burr’s brother-in-law, Gerald Fauth, called his broker.

ProPublica previously reported that Fauth, a member of the National Mediation Board, had dumped stock the same day Burr did. But it was previously unknown that Burr and Fauth spoke that day, and that their contact came just before Fauth began the process of dumping stock himself.

The revelations come as part of an effort by the SEC to force Fauth to comply with a subpoena that the agency said he has stonewalled for more than a year, and which was filed not long after ProPublica’s story.

Recent Posts

Minneapolis: Organizing for the Protection of the Community

February 18, 2026

Take Action Now In speaking with residents in several parts of Minneapolis, beautiful stories of organizing on a block-by-block level emergedBy…

U.S. Sent a Rescue Plane For Boat Strike Survivors. It Took 45 Hours To Arrive.

February 17, 2026

Take Action Now In seas that could kill a person within an hour, it took nearly two days for a rescue plane to arrive.By Tomi McCluskey and Nick…

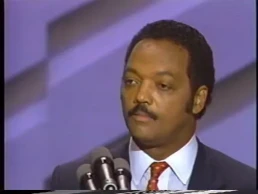

“Keep Hope Alive”: Remembering Rev. Jesse Jackson, Civil Rights Icon Who Twice Ran For President

February 17, 2026

Take Action Now “Our father was a servant leader — not only to our family, but to the oppressed, the voiceless, and the overlooked around the…

The Iranian Trap: Neither Military Action Nor Nuclear Negotiations Can Solve Trump’s (and Israel’s) Conundrum

February 16, 2026

Take Action Now After a failed regime-change strategy and an increasingly risky military buildup, the Trump administration turns back to nuclear…