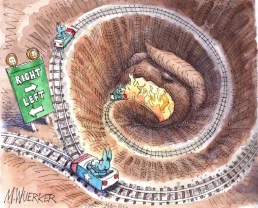

Charles Littlejohn, a former IRS contractor, leaked the tax returns of the rich to show the public how the uber-wealthy game our tax code. Now he’s facing potential prison time. They’ve nabbed the wrong criminal.

by Guthrie Scrimgeour, Jacobin

In June 2021, the investigative reporting outlet ProPublica began publishing “The Secret IRS Files,” a series of articles analyzing a leaked cache of the wealthiest Americans’ tax documents.

The series was shocking. Over the course of more than a year, it laid out in detail the methods by which the uber-rich — with their armies of accountants, lawyers, and friendly politicians — rig the tax code to their benefit. In many cases, the documents revealed, billionaires pay a lower effective tax rate than their working-class employees, or pay no taxes at all.

In a functioning democracy, these revelations would spark meaningful changes in the tax code, and the person responsible for the leaks would be lauded as a hero for alerting the public to massive government dysfunction. Instead, President Joe Biden’s Department of Justice, badgered by congressional Republicans, elected to prosecute the whistleblower.

Recent Posts

Despite Marco Rubio’s Warnings, This is the Time to Go to Cuba in Solidarity Against the Latest U.S. Aggressions

February 10, 2026

Take Action Now When visiting Cuba, one can see quickly the terrible effects of the almost seven decades of the U.S. economic blockade of Cuba.By…

“Hands Off Cuba!”: Left Groups in Europe Mobilize Against U.S. Aggression

February 10, 2026

Take Action Now Hundreds demonstrated in Belgium in solidarity with Cuba as further mobilizations against US imperialism are planned across Europe.……

Democrats Propose Minor Reforms for ICE — and Record Funding

February 10, 2026

Take Action Now Congressional Democratic leaders are asking ICE to agree to reforms, promising to vote for $11 billion in funding for the agency if…

Why We Need to Complain About Democrats

February 9, 2026

Take Action Now Too often, centrist Democrats work against progressives, as with NAFTA and the Crime Bill that accelerated mass incarceration.WORT…