James K. Galbraith: There is no compelling reason to raise interest rates, now or later.

By James K. Galbraith, The Nation

In stating recently that “inflation is the Fed’s job,” President Biden gave compact expression to three radically false and politically suicidal propositions: 1. The past year’s price increases are part of a process that must be suppressed. 2. Anti-inflation policies are the preserve of the central bank. 3. The Federal Reserve can suppress inflation without also wrecking the economy, the president’s own program, his party, and his political prospects.

Let me offer three counter-propositions: 1. There is no compelling reason to raise interest rates, now or later. 2. Nevertheless, future price pressures are inevitable. 3. A progressive anti-inflation strategy is possible and necessary—one that supports jobs and living standards and doesn’t involve the Federal Reserve.

Why have prices risen this year? First of all, because world oil prices jumped in the spring of 2021, while supply chain troubles hit new car production and drove up used-car prices. Those were the big items. They were onetime hits, in the case of oil largely over by July, which make new headlines every month only because the government reports price changes 12 months later. Though some effects will linger, these big shifts will drop from the news reports automatically as 2022 moves along.

Wages are also rising, finally—a bit. Since most American jobs are in services, those wages are also prices. And they are prices that are paid—this should be an obvious point—by people wealthier than those who are getting paid. Suppressing wage increases for low-wage American workers is reactionary. And it’s a result that can be achieved only by gouging those workers and their families on their debts and then cutting off their bargaining power over their jobs.

Recent Posts

U.S. Sent a Rescue Plane For Boat Strike Survivors. It Took 45 Hours To Arrive.

February 17, 2026

Take Action Now In seas that could kill a person within an hour, it took nearly two days for a rescue plane to arrive.By Tomi McCluskey and Nick…

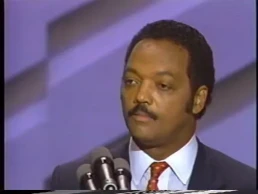

“Keep Hope Alive”: Remembering Rev. Jesse Jackson, Civil Rights Icon Who Twice Ran For President

February 17, 2026

Take Action Now “Our father was a servant leader — not only to our family, but to the oppressed, the voiceless, and the overlooked around the…

The Iranian Trap: Neither Military Action Nor Nuclear Negotiations Can Solve Trump’s (and Israel’s) Conundrum

February 16, 2026

Take Action Now After a failed regime-change strategy and an increasingly risky military buildup, the Trump administration turns back to nuclear…

Suffocating an Island: What the U.S. Blockade Is Doing to Cuba

February 16, 2026

Take Action Now Electric motorcycles are Cuba’s response to the fuel crisis.By Medea Benjamin Marta Jiménez, a hairdresser in Cuba’s eastern city…