The yacht-owning coal baron crushed low-income families while representing one of America’s poorest states.

By Brian Martin, David Sirota, The Lever

Despite representing one of America’s poorest states, West Virginia Sen. Joe Manchin (D) decided in 2021 to kill legislation to extend expanded child and antipoverty tax credits that were helping the working class.

The expiration of the expanded tax credits resulted in more than three million kids being thrown into poverty. New data shows it also resulted in a massive regressive tax increase on the working class.

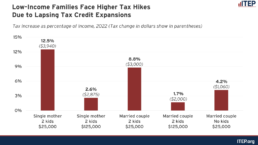

The numbers from the Institute On Taxation And Economic Policy are stark: The Manchin Tax Increase resulted in single moms with two kids who were making $25,000 a year being hit with a 12.5 percent tax increase, and married couples with two kids who were making the same amount being hit with a nearly nine percent tax increase.

Recent Posts

Militarized Immigration Enforcement Incompatible With Democracy

February 1, 2026

Take Action NowICE’s targeting of virtually anyone who is not white and English-speaking — including, ironically, Native Americans — exposes this…

Trump’s Back-and-Forth Threats on Iran Are Psychological Warfare

January 31, 2026

Take Action NowAs Trump threatens Iran yet again, Congress continues to abdicate its responsibility to rein in war.By Hanieh Jodat, Truthout As…

U.S. Media Keen on Iranian Unrest—Less So on U.S. and Israel’s Role in It

January 30, 2026

Take Action Now Democrats have a rare moment of leverage to pass legislation ending qualified immunity for Immigration and Customs Enforcement…

The Senate Must Not Fund ICE, A Zero Hour Conversation With Sonali Kolhatkar

January 30, 2026

Take Action Now “We’ve seen a really sharp change in how the public views immigration enforcement, particularly ice, to the point where…