As Wall Street fights legislative crackdowns, J.D. Vance and other top lawmakers have tens of millions invested in private equity — and most don’t have to disclose the details.

By Katya Schwenk, The Lever

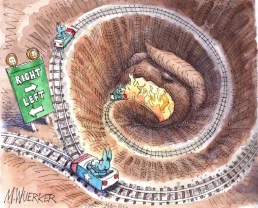

As political battles loom over whether to crack down on Wall Street’s tax breaks and predatory behavior, the wealthiest members of Congress from both parties — including Republican vice presidential candidate J.D. Vance — now have tens of millions of dollars collectively invested in private equity funds.

The quantity and scope of these private equity investments are growing, even as some of these same lawmakers launch bipartisan probes into the industry and Democrats warn the funds “threaten U.S. health care and block Americans from economic success.”

In many cases, these lawmakers — several of whom have recently received hefty private-equity political donations — don’t have to disclose much about these investments. The secrecy makes it difficult to discern whether these financial dealings could pose a conflict of interest.

According to a review of recent congressional financial disclosures by The Lever, 10 United States senators and 16 representatives together have more than $150 million invested in private equity, an opaque, predatory industry that critics warn is pillaging everything from health care to housing to Minor League Baseball. Private equity firms invest in companies that aren’t publicly traded on the stock market, which limits transparency around the acquisitions.

Because these disclosures list only an estimated range of value for each reported asset (with some parameters as broad as “between $1 million and $5 million”), this figure is almost certainly a significant undercount.

Some of these same lawmakers are in turn beneficiaries of the private equity industry’s current spending spree in the lead-up to the November elections. Threatened by the willingness of some members of Congress — such as Sens. Jeff Merkley (D-Ore.) and Elizabeth Warren (D-Mass.) — to take on the industry, and with a high-stakes tax fight looming, the industry has poured more than $150 million into the 2024 elections, according to data compiled by OpenSecrets, outpacing its campaign spending in the 2020 cycle by $20 million.

But with few limits on how much money lawmakers can stow in clandestine private equity funds — and little transparency around when that cash could prove a conflict of interest — many Congress members already have financial ties to the industry.

Recent Posts

Despite Marco Rubio’s Warnings, This is the Time to Go to Cuba in Solidarity Against the Latest U.S. Aggressions

February 10, 2026

Take Action Now When visiting Cuba, one can see quickly the terrible effects of the almost seven decades of the U.S. economic blockade of Cuba.By…

“Hands Off Cuba!”: Left Groups in Europe Mobilize Against U.S. Aggression

February 10, 2026

Take Action Now Hundreds demonstrated in Belgium in solidarity with Cuba as further mobilizations against US imperialism are planned across Europe.……

Democrats Propose Minor Reforms for ICE — and Record Funding

February 10, 2026

Take Action Now Congressional Democratic leaders are asking ICE to agree to reforms, promising to vote for $11 billion in funding for the agency if…

Why We Need to Complain About Democrats

February 9, 2026

Take Action Now Too often, centrist Democrats work against progressives, as with NAFTA and the Crime Bill that accelerated mass incarceration.WORT…